Giving from Your Retirement Plan

Leave family the balance of savings and checking accounts, and donate double-taxed assets like IRAs to us.

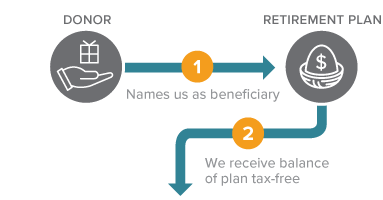

How It Works

- Name The Oregon State University Foundation as a beneficiary of your IRA, 401(k), or other qualified plan.

- Designate us to receive all or a portion of the balance of your plan through your plan administrator.

- The balance in your plan passes to Oregon State University Foundation after your death.

Important Related Topics

Benefits

- Avoid the potential double taxation your retirement savings would face if you designated them to your heirs.

- Continue to take regular lifetime withdrawals.

- Maintain flexibility to change beneficiaries if your family's needs change during your lifetime.

- Leave a lasting legacy by creating an endowed fund in your or your family's name

Next

- More detail on retirement plans.

- Frequently asked questions on retirement plans.

- Contact us so we can assist you through every step.